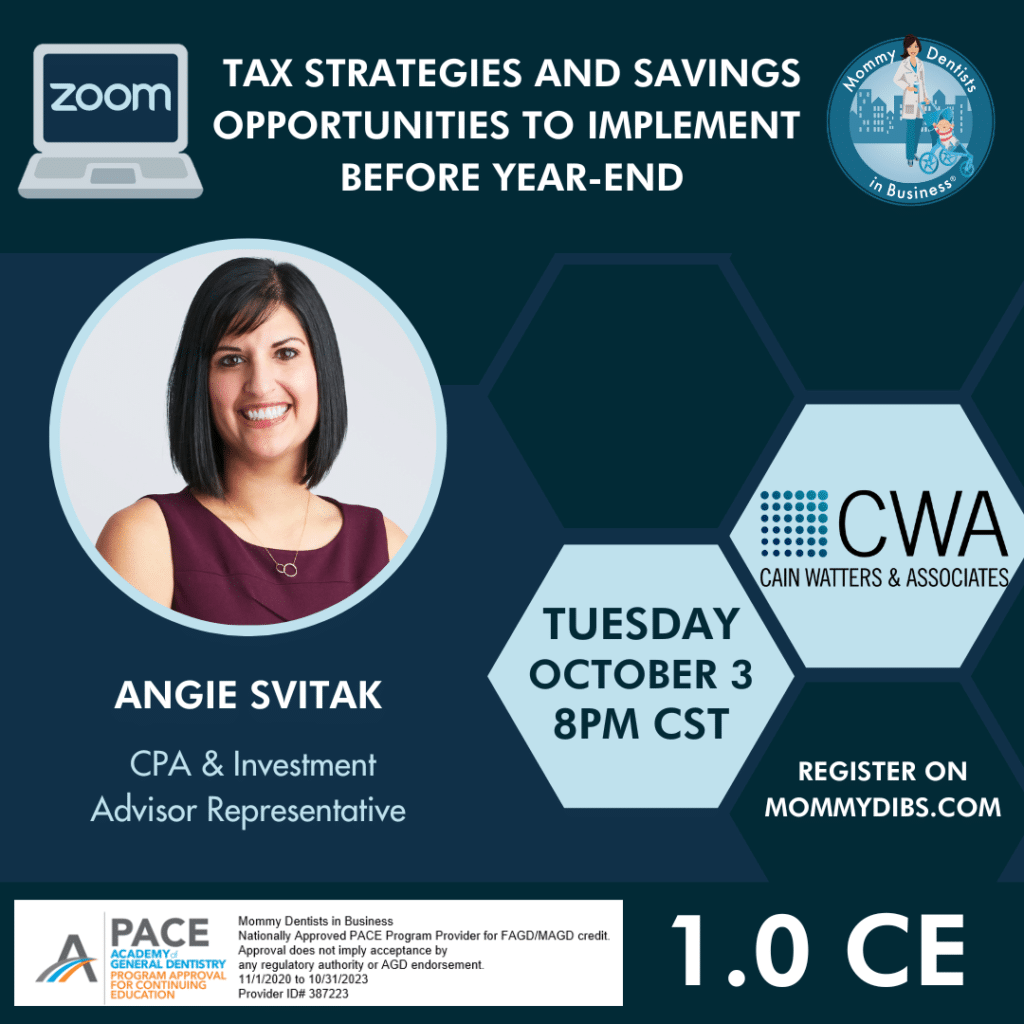

Live Webinar Details

Tax Strategies and Savings Opportunities to Implement Before Year-End

- October 3, 2023 @ 8:00 PM CST

EARN 1.0 CE CREDITS

Juggling motherhood and a career in dentistry is a balancing act. And while the profession offers a range

of benefits, from maintaining a flexible lifestyle, job stability, and an opportunity to help others, it

certainly comes with challenges, especially while raising a family. It’s hard to do it all, and maybe your

financial plan took a backseat this year. Luckily there’s still time to finish strong.

Before you flip the calendar on another year, now is the time to pause and review your situation to

ensure you’ve maximized your tax benefits as a business owner. In this new webinar, CPA and Financial

Advisor Angie Svitak will share the tax savings opportunities and strategies that can reduce your tax

burden and propel your dental practices’ growth and profitability.

Objectives:

Learn how to adjust your tax planning and savings strategies to withstand this volatile economy.

Know the items you need to act on before December 31 st that can save you money this year.

Special Guest(s):

Angie Svitak

Brought To You By:

Additional Notes

- Webinar Registration Closes ONE HOUR prior to Webinar Start Time

- Payment must be received by webinar start time. No registrations will be approved after the webinar begins.

- Attendee Must be Present for 90% fo webinar running time in order to be eligible for continuing education credits